With the pandemic creating chaos in global food supply chains and a corresponding increase of meat-free options coming to market, we polled Singaporeans and Americans to get a view on their attitudes and consumption of alternative protein sources. Using the PureSpectrum Insights Platform, we were able to gauge attitudes, awareness, and motivating factors impacting purchases across two major driving nations.

Our Relationship With Food

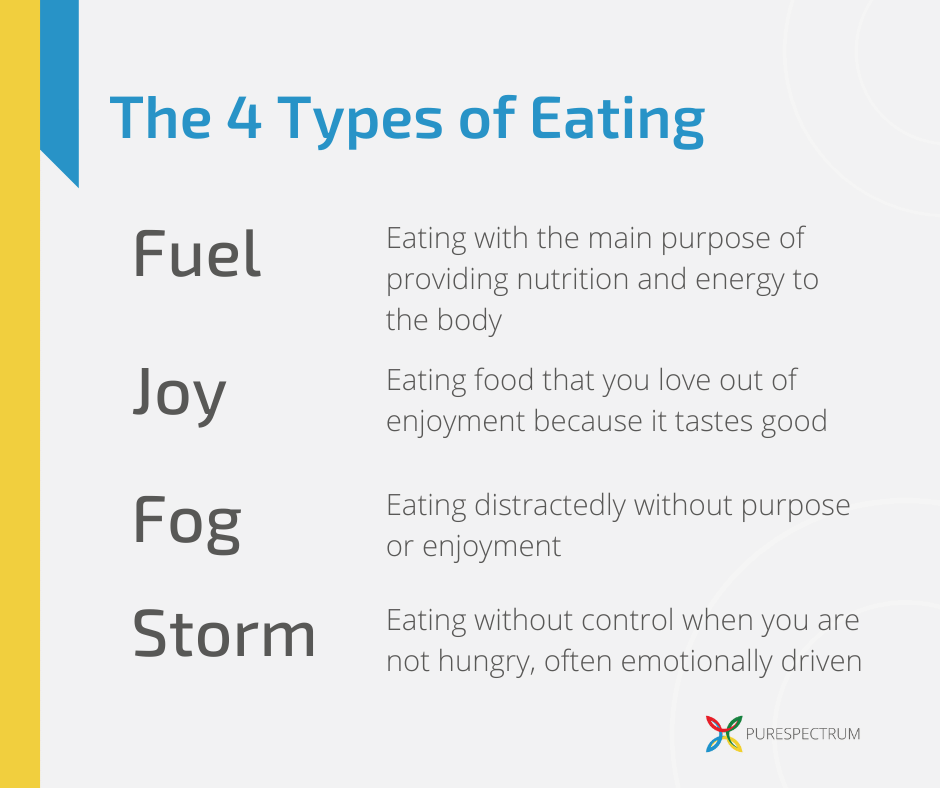

To set a common benchmark, we first looked at people’s general relationship with food. Given the 4 options of Eating Types, there were strong parallels between Singaporeans and Americans when it came to their consumption engagements.

Both audiences were inclined to engage in Fuel Eating (eating with the main purpose of providing nutrition and energy to the body) and Joy Eating (eating food that you love out of enjoyment because it tastes good). Less of our respondents reported Fog Eating (eating distractedly without purpose or enjoyment) and Storm Eating (eating without control when you are not hungry, often emotionally driven) demonstrating a consensus on implementing ‘healthier’ habits.

Eating In or Out?

Next, we looked at the differences in eating/purchase habits as they relate to everyday meals. We found that in Singapore, it is less common to prepare meals in advance, perhaps in part due to the opportunity to visit Hawker centers or cafes vs. preparing a packed lunch. On average, almost twice as many Americans prepare food ahead of time compared to Singaporeans. (133 vs. 77)

Source: PureSpectrum Insights Platform

As traditional local cuisines vary considerably from market to market, it was interesting to look at how diet trends were being observed and followed. When asked about “health diets” including Keto, Paleo, plant-based, and other meat substitutes, there was strong alignment between the US and Singapore. There was a noticeable difference however in respondents following ‘dairy alternatives”, the practice appears to be more prominent in the South East Asian market. 40% more Singaporeans were inclined to seek out non-dairy sources such as almonds, soy, seeds, etc. than their American counterparts.

Source: PureSpectrum Insights Platform

Why No Meat?

Diving deeper specifically into meat alternatives, we wanted to ask our audiences about the motivations behind vegetarian and vegan diets. While the environment and religion motivate differently depending on location, it was clear that both audiences perceived personal health to be the overall motivator. Animal welfare was the second most common motivator for meat-free choices.

Source: PureSpectrum Insights Platform

Similarly, both samples demonstrated a significantly stronger opinion that plant-based meat was a healthier alternative to regular meat than those who claimed to be opposed to meat substitutes!

Beyond or Impossible?

Looking at the dominant alternative brands, it seems that Impossible (76% recognition) and Beyond (69% recognition) are now household names. However, when we took a look at awareness of recent Asian-based success stories entering the US market, it’s clear they have not gone unnoticed! Hong Kong’s Omni brand saw 52% awareness overall and Singapore’s Temasek-backed Tindle saw 19.2% recognition.

On reviewing the results of our survey, Andre Menezes Co-Founder and CEO of TiNDLE highlighted:

“Considering the fact that 10 years ago this category was not really an existing one, it is impressive to see how many people are aware of the sector and brands and how many people consider eating plant-based. It is an incredible shift when we take into consideration that animal farming has been predominant for thousands of years and animal-based products were constructed as an aspirational ingredient in society over time.”

Summary

With information about vegan lifestyles becoming more available, as well as more variety in the supermarket, both Americans and Singaporeans demonstrated high levels of awareness and understanding when it came to alternative food options. Taking into consideration the different locales and customs, attitudes appear to be aligned, believing that some meat alternatives are better than the originals.

That being said, a resounding 47% of respondents were adamant they would not be trying protein-rich insects anytime soon and only 11% said they consume them regularly! Insects seem to be the meat alternative that these two nations are not quite ready to fully embrace.

If you would like to learn more about how you can quickly collect consumer sentiments, get in touch with us. We are also happy to share additional insights and crosstabs from our survey.

Methodology

PureSpectrum interviewed 602 online respondents between April 07, 2022, and April 08, 2022, using the PureSpectrum Insights Platform. The platform is integrated with the PureSpectrum Marketplace which combines proprietary measurement tools and third-party data validation to quickly collect high-quality insights. The study targeted people within the United States and Singapore and consisted of a general population audience of 18+ years old. This study uses a 95% confidence level to examine the data.